Amazon’s investments in the healthcare sector point to an emerging offering to rival traditional healthcare services. We break down the reasons why the company needs the healthcare sector, its investments to date and what we foresee it is building towards in the midst of the ongoing disruption of the industry.

Why does Amazon need the healthcare sector?

To understand Amazon’s growth needs, you have to understand the market’s expectations for Amazon’s growth. Amazon is a company likely have about $400B in revenue, and $20B in operating margin during 2020 – but still has a P/E (price earnings) ratio of about 60. That is extremely high compared to the overall long-term Dow Jones P/E ratio of about 161, meaning Amazon would need to about triple earnings (think about finding about $50B in new profits) just to have the average stocks growth projections at the CURRENT stock price (trust us, everyone there wants that stock to go up, not down).

For Amazon to triple earnings, mathematically there are lots of ways to get there, but it generally requires finding large growing markets with higher margins than its existing product lines. At least in the US market, there is a consistent place to get that: healthcare. The healthcare market is expected to be over $6 trillion dollars in 20282 and is almost universally agreed to be a…mess. As Anurag Gupta of Gartner has said, Amazon is attracted to markets where they see “a lot of uneven profit margins being distributed, where a few companies are making a lot of money, they have high profit margins and customers are unhappy.”3 Healthcare is one of the few service businesses where customers put up with waiting and challenging service (e.g. pharmacy lines, insurance confusion, waits for provider appointments, ER frustration and infection risk). There are often very good reasons for these challenges, but tech companies have proven to be very adept at unbundling the customers and serving a profitable group very well.

What has Amazon done so far in healthcare?

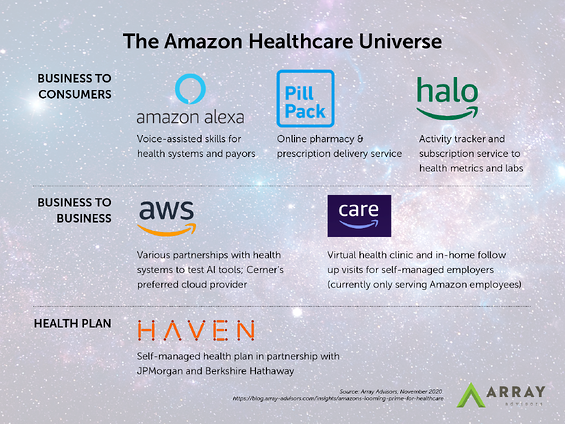

Amazon’s investments and partnerships are in apparently scattered corners of the health industry. On one end, it has extended its existing core services and products, such as AWS and Alexa, to new healthcare applications. On the other, it has gone way beyond its traditional business and entered the healthcare delivery space.

- Devices: Alexa is now HIPAA-compliant and used by a growing number of health systems, apps, and even insurers — including Cigna — to answer health questions, check prescriptions and schedule doctor visits. The recently-launched Halo wearable measures the typical fitness tracker metrics (activity, sleep) plus body composition and a totally new feature not seen in other wearables to date: your tone of voice, which is intended to help improve communication and provide insight into the state of your behavioral health. Halo also includes Labs, which connects users to evidence-based challenges and workouts, and it also enables them to share their data with third parties and even their providers via Cerner. John Hancock, a life insurance provider, is integrating Halo into its Vitality wellness incentive program. Amazon has also recently launched “CareHub” for Alexa, a feature that allows family caregivers to check in on aging relatives through their device, a step they are calling “day one” for moving into the aging space, noting that there is a lot more they can do to help seniors age in place.4

- Cloud computing: Through AWS, Amazon has formed a variety of partnerships in the healthcare space with both providers and payers. Beth Israel Deaconess has been a partner since 2016, after purchasing AWS cloud software which it then used to improve operational efficiency, and in 2019 Amazon made a $2M investment in the partnership to test artificial intelligence tools. AWS is also working with The Pittsburgh Health Alliance (UPMC, University of Pittsburgh, and Carnegie Mellon University) to advance innovation through the use of the AWS Machine Learning Research Program. Similarly, AWS has partnered with UT Health Science Center, Cardinal Health and digital health company Virtusa to use artificial intelligence in medical research. UNC Health used AWS to build a chatbot that answers questions for patients seeking guidance on COVID-19. Last year, Cerner made AWS its preferred cloud provider and hopes that it will drive enhanced utilization of the EMR, reduce operational burdens, and improve patient outcomes.

- Pharmacy services: With PillPack, its mail-order/online pharmacy service, Amazon now offers free delivery of prescriptions and over-the-counter medications and accepts many insurances. BCBS of Massachusetts is even integrating PillPack into its member app.

- Self-managed health plan: In partnership with JPMorgan and Berkshire Hathaway, Amazon created Haven with the vision of establishing a self-managed health plan for its combined 1.2M employees. So far, the venture has been relatively quiet, and sources indicate it has started by working with existing health insurers to offer employees plans, rather than creating its own.5

- Healthcare delivery: With the creation of Amazon Care, the company now offers its employees in Washington State offices and warehouses access to virtual health clinics and in-home follow up visits. It is powered by Health Navigator, which provides preliminary and final diagnoses and treatments on its digital platform. Amazon hopes to extend its Amazon Care offering to HQ2 employees in Virginia.6 Amazon is also working to build 20 neighborhood health clinics for warehouse workers and their families across five cities as part of a pilot program, in partnership with Crossover Health, who will operate and staff the facilities. These centers will initially be located in Dallas, Phoenix, Louisville, Detroit and San Bernardino.7

Some inside and outside of Amazon last year believed it was experimenting but had no grand plan – that Bezos was waiting on people to bring him opportunities. However, over the past year, a more proactive and comprehensive strategy appears to be emerging.

How will Amazon evolve in healthcare?

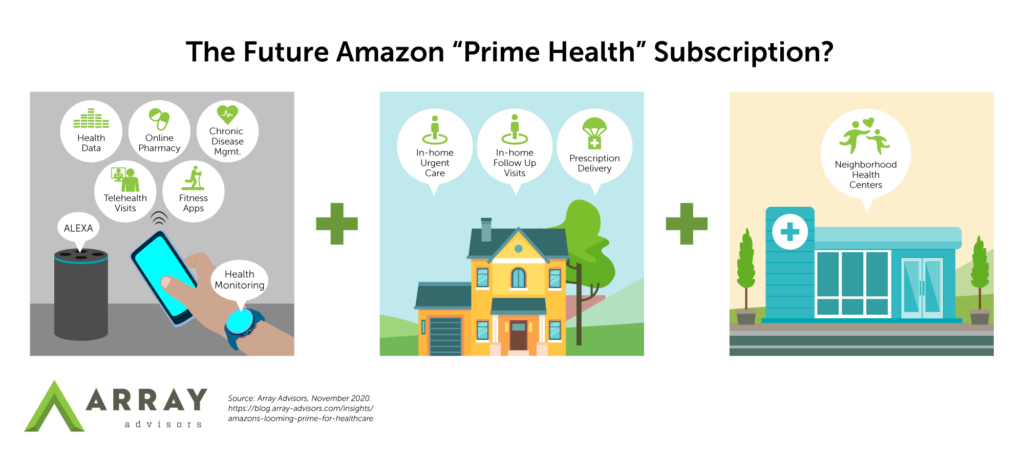

Through its Amazon Care model for its employees, the company is in step with innovators in the market who are developing the next generation of how primary care will be delivered. Recent funding rounds have brought attention to companies developing similar telehealth solutions paired with in-home care on demand, such as Nice Healthcare8 and Vitable Health.9 Both of these startups offer access to their services for a flat rate membership fee. With its existing Prime membership infrastructure and Alexa-powered devices, Amazon would be well positioned to expand into this market.

There are a few signs that Amazon is already headed in this direction. In addition to a project manager role that will advance the building of more health centers for its employees, Amazon Care has listed a number of business development manager job postings, including one whose purview will include defining and executing a strategy for “acquiring and managing provider networks,” and another whose role will be to “build and grow relationships with commercial and public sector enterprises.”10 Both point to an intent to broaden its services to more than just its own employees. On the health insurance front, Amazon may also be looking to expand, as evidenced by a recent survey it sent out to its 900,000 e-commerce sellers asking about insurance needs and pain points.11 As for AWS, recent job postings for a Senior Manager of Healthcare Policy and a Principal of Business Development (Healthcare) indicate a long-term, global vision for the development of AWS-enabled healthcare solutions.

Based on the scope and breadth of the pieces it has so far, it is no longer a stretch to say Amazon is inching towards becoming a comprehensive, digitized healthcare provider of the future, one which, as Aaron Martin of Providence says, “will compete for the first premium dollar” and like other coming disrupters, “look to make IDNs price takers.”12 In effect, we believe Amazon is building a “Prime” subscription service for healthcare. As others have postulated, this would be “a consumer-facing subscription model for healthcare goods and services…a one-stop shop for everything from telehealth to IoT networks, chronic disease management to medical devices to your actual drug supplier, and everything in between.”13 Like its retail web site, it could be a platform for third party providers when needed, knowing Amazon gets market knowledge and leverage along the way to allow it to successfully enter markets if they are attractive.

Where will it start?

Amazon has never been an all-in or nothing operation. While it is firmly a tech company now, its roots in retail shape its approach to development. Retail is constantly testing and tweaking products before a full rollout, using an incremental strategy to ensure the idea and its individual components are solid before it goes big. The company launched Amazon Go, its convenience store model without cashiers or check out lines, only after extensively testing the concept with its own employees and then piloting a store in Seattle. It now has locations in 10 cities.14 After acquiring PillPack, Amazon first moved its employees to its prescription service before it launched it offered it to the broader public.15 Now we see Amazon Care following a similar pattern – it was first piloted with Seattle employees, then extended to Seattle warehouse employees, and will follow with HQ2 employees in Virginia.

The reality is that providing health care will necessitate some physical presence and that takes time to build (e.g., Amazon diagnoses a condition remotely but needs to send the member for specialized testing. Where do you send them to?). Even One Medical (a concierge health care practice focused on primary care) faced these challenges. One Medical was started in 2007, received significant capital investment in 2017, and just had its IPO this year. it is now in just 12 cities – looking to expand to 4 more very soon. Even with a nine-figure capital investment, it has taken time for One Medial to create the network of doctors, employers and specialists required to create a viable healthcare ecosystem in each city.

It makes the most sense that the “Prime”-type offering we’re imagining will first be tested in markets where Amazon is establishing its Amazon Care and neighborhood health centers for its employees, but those are not the only factors to consider. To make our best guess of the most likely candidates for potential future Amazon health hotspots, we developed a model that accounts for four key variables across the top 100 most populated metropolitan areas:

- Need – Defined by high relative commercial rates, signaling entrenched incumbents vulnerable to disruption.

- Economics – Defined by median household income (which we know is correlated to Prime membership and Alexa adoption16).

- Market Willingness – Defined by current telehealth adoption rate.

- Existing Footprint – A combination of number of fulfillment centers, announced sites of future Amazon Neighborhood Health Clinics, and HQ2 finalist status.

Our results:

Explore an interactive version of this map and associated data.

What does that mean for health systems and hospitals?

Our next blog post on this topic will address in detail what this means for health systems. We will suggest, for now, that the local lockdown of provider networks can carry the day against other health systems and provide leverage against payors. However, that is not going to be enough to stop Amazon.

Subscribe to the Array Advisors blog and get notified of our next installment in this series.

Sources:

- [1] Gleeson, P. (2019, March 31). “What is the Long-Term Average PE of the Dow Jones?”. Zacks. (Link)

- [2] Office of the Actuary, Centers for Medicare and Medicaid Services. (2020, March 24). “National Health Expenditure Projections 2019-28”. (Link)

- [3] Best, J. (2019, January 7). “Amazon’s next big thing? Prime, but for healthcare”. ZDNet. (Link)

- [4] Farr, C. (2020 November 11). “Amazon Alexa Care Hub update will make it easier to help aging family members”. (Link)

- [5] Koons, C. (2020, May 21). “The Amazon-Berkshire-JPMorgan Health Venture Fails to Disrupt”. Bloomberg. (Link)

- [6] Capriel, J. (2020, March 3). “Amazon may expand telemedicine services to HQ2 employees”. Washington Business Journal. (Link)

- [7] Nicklesburg, M. (2020, July 14). “Amazon plans 20 healthcare clinics across U.S. for warehouse employees and their families”. GeekWire. (Link)

- [8] Reuter, E. (2020, October 21). “Nice Healthcare brings primary care to small businesses”. MedCity News. (Link)

- [9] George, J. (2020, October 21). “Delaware County urgent care provider lands investment led by SoftBank’s minority-focused fund”. Philadelphia Business Journal. (Link)

- [10] Soper, T. (2020, October 19). “Amazon’s healthcare job postings reveal interest in buying provider networks, expanding Amazon Care”. GeekWire. (Link)

- [11] Landi, H. (2020, October 7). “Here’s how Google, Amazon, Facebook and Apple are targeting the health insurance market”. Fierce Healthcare. (Link)

- [12] HealthIMPACT Fall Forum Live. (2020, October 2). “Journey Towards the New Normal and the Next One – Make or Break Moment for Value and Innovation – is COVID-19 Accelerating Journey Towards Value Based Care?”. (Link)

- [13] Best, J. (2019, January 7). “Amazon’s next big thing? Prime, but for healthcare”. ZDNet. (Link)

- [14] Day, M. (2018, January 21). “Amazon Go cashierless convenience store opens to the public in Seattle”. The Seattle Times. (Link)

- [15] Japsen, B. (2020, March 23). “Amazon Shifts Employees to PillPack and PBM RxAdvance”. Forbes. (Link)

- [16] Columbus, L. (2018 Mar 4). “10 Charts That Will Change Your Perspective of Amazon Prime’s Growth”.(Link)